In this article Easify lead QA Alison Moore talks about some of Easify's built in VAT handling features.

"Unlike a lot of other software programs that have to issue updates to their code when the VAT rate changes, Easify allows you to change the VAT rates yourself."

How to Easify VAT

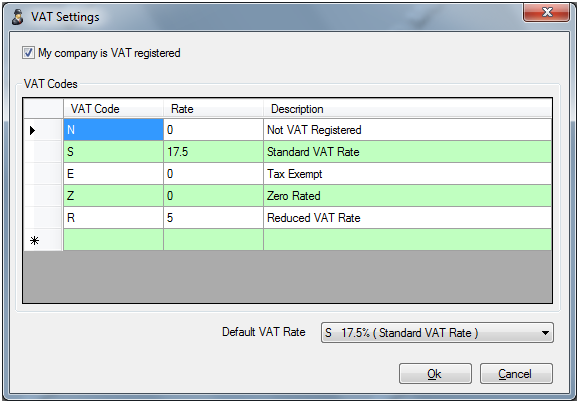

Easify accommodates for both VAT registered or non VAT registered companies.

Under Tools, VAT Settings you can amend your VAT status and VAT rates at any time:

Under the default Easify settings we have entered the main VAT codes, however you can add and edit them as you need. For instance, if you export a lot of goods within the EU you will probably need to add an EU VAT code, but your VAT office can provide advice on this.

Dealing With VAT Changes

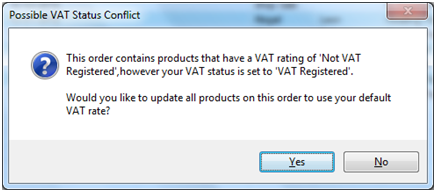

Easify will check to see if there have been any changes to your VAT status when you edit Orders or Quotes. Therefore if you open an order that you raised when you were not VAT registered (but you have since become VAT registered) Easify will ask you if you want to update your tax rates:

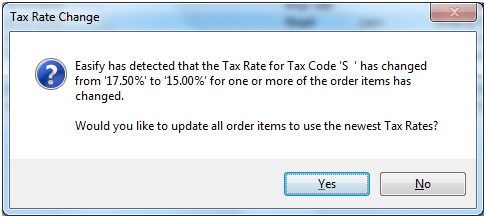

Unlike a lot of other software programs that have to issue updates to their code when the VAT rate changes, Easify allows you to change the VAT rates yourself.

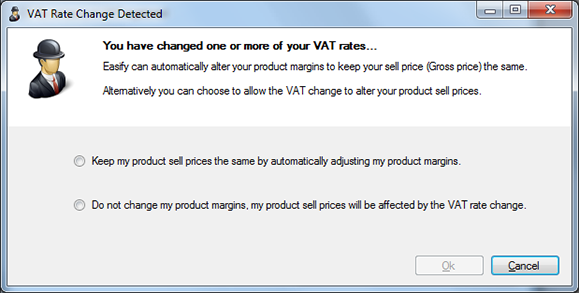

If a VAT rate changes – for example the Standard VAT Rate changes from 15% to 17.5%, Easify will check to see if there have been any changes to your VAT rates when you edit Orders or Quotes. Therefore if you open an order that you raised when the standard VAT rate was 15% (but it has since become 17.5%) Easify will ask you if you want to update your tax rates:

When you change a VAT rate easify will ask you if you want to pass the VAT change onto your customers, or whether you want to absorb the VAT rate change into your sell prices.

So to change the standard rate of VAT in 2011 simply go to the Tools > VAT Settings menu in Easify, change the standard rate of VAT from 17.5 to 20 and click Ok. When prompted choose whether to keep your sell prices the same, or to pass the VAT rise onto your customers. Easify will take care of the rest.

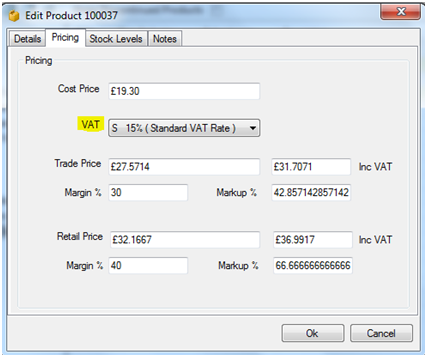

Default VAT Rate

You can also set the default VAT rate for your company which will be applied to all your products. However many businesses sell a variety of products at different VAT rates, therefore you can easily change the VAT rate on a product by product basis in the Edit Product window:

There are many ways of calculating VAT that are acceptable to the VAT office. As Easify accommodates the selling of products we have selected the recommended VAT calculation method for products. This ensures that the product price is always consistent.

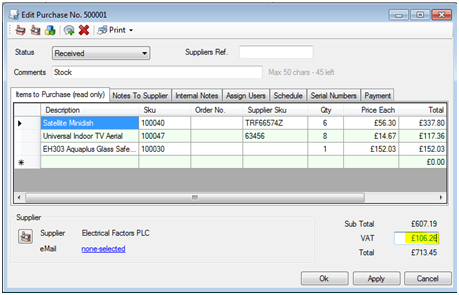

VAT and Purchases

When raising purchases you can enter VAT as shown on your supplier invoice or receipt. Easify will automatically calculate the VAT, however if this differs from the receipt, you can adjust it in the VAT box. If you have adjusted the VAT, it shows in green, as shown below: