How to Make a VAT Adjustment

Sometimes it is necessary to file an adjustment to your VAT return.

This might be because you have made an error on a previous return, or HMRC or your accountant have informed you that you need to make an adjustment.

Always speak to you accountant if you are unsure whether to make an adjustment to your VAT return.

NOTE: The ability to file VAT adjustments was introduced in V4.80 so if you are using a previous version you will need to upgrade.

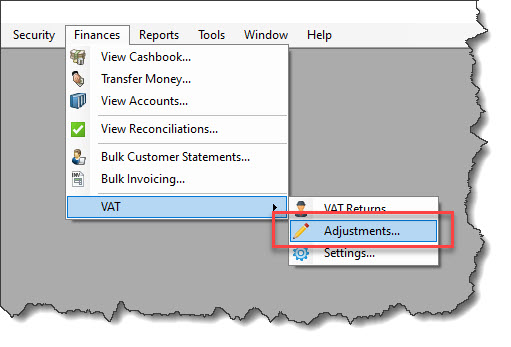

To make an adjustment Click on Finances -> VAT -> Adjustments

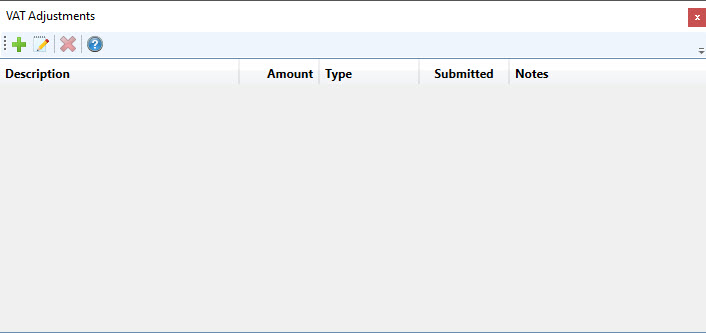

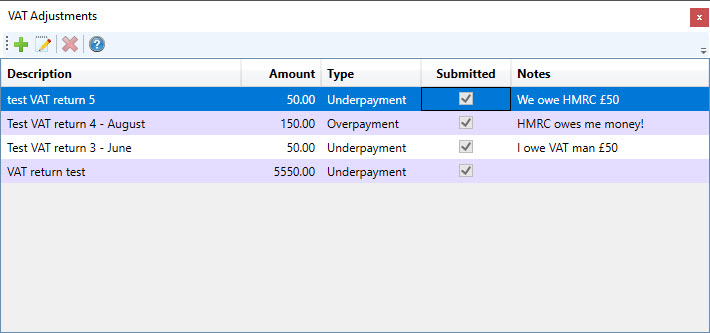

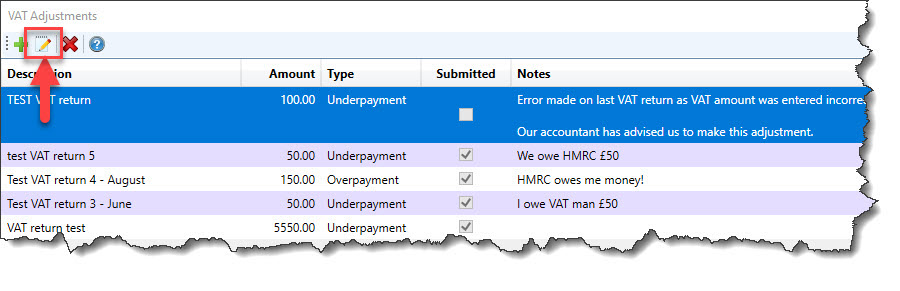

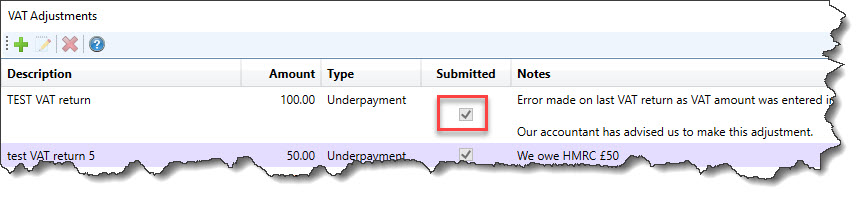

This will bring up the VAT Adjustments window. If this is the first time you have used this feature it will show blank, however as you start and record your adjustments they will show in here.

The screen shot below has been taken from one of our test databases, and so far four test VAT adjustments have been entered. As this is a test database, the notes recorded against the adjustments don't provide much useful information, however in a real life scenario, the notes recorded against the adjustments should be more descriptive.

Here you can Add, Edit and Delete VAT adjustments, however you will only be able to:

- Add a New Adjustment against a valid VAT return

- Edit or Delete Adjustments if they haven't yet been submitted on a VAT return to HMRC.

How to Enter a new VAT Adjustment

To enter a new VAT Adjustment:

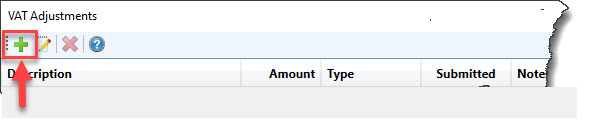

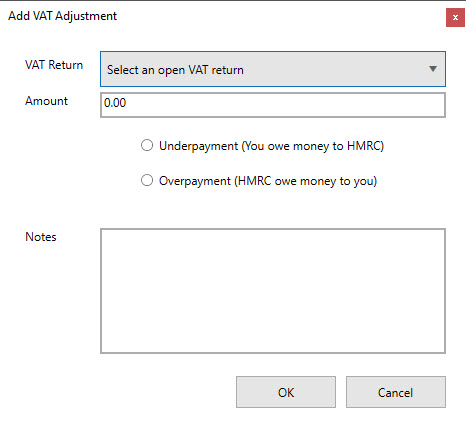

Click on the Add new VAT Adjustment (Green Plus) button

This will open the Add VAT Adjustment window.

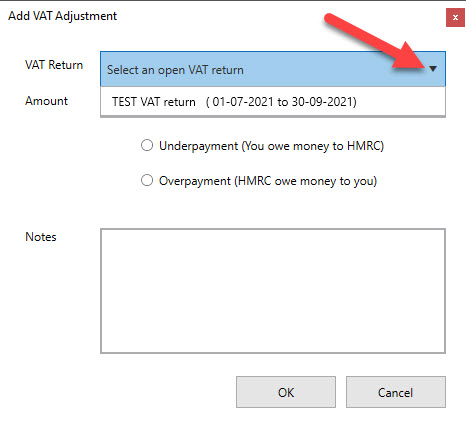

Click on the Drop down arrow next to the VAT Return field to select a current VAT return to apply the adjustment to:

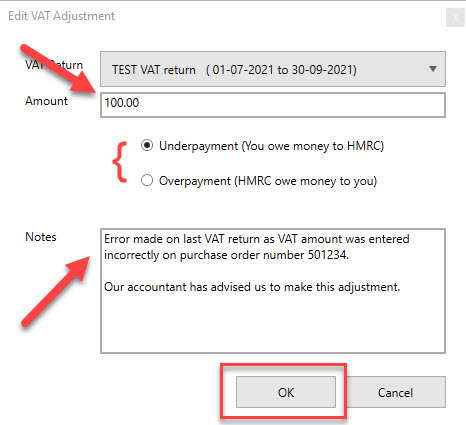

Enter the Amount of the VAT adjustment

Tick to say whether it is an

- Underpayment - i.e. you have underpaid the amount of VAT due to HMRC and you owe HMRC this amount of VAT.

- or an Overpayment - i.e. you have overpaid the amount of VAT due to HMRC and HMRC owes you this amount of VAT.

Add some detailed Notes explaining why you are making this adjustment.

Bear in mind, that you have to keep Company financial information for at least seven years so you might find yourself having to explain to HMRC several years down the line why you have made this adjustment, so the more details you record here, the better.

6. Click OK to Save, (or click Cancel if you decide you don't want to save this adjustment).

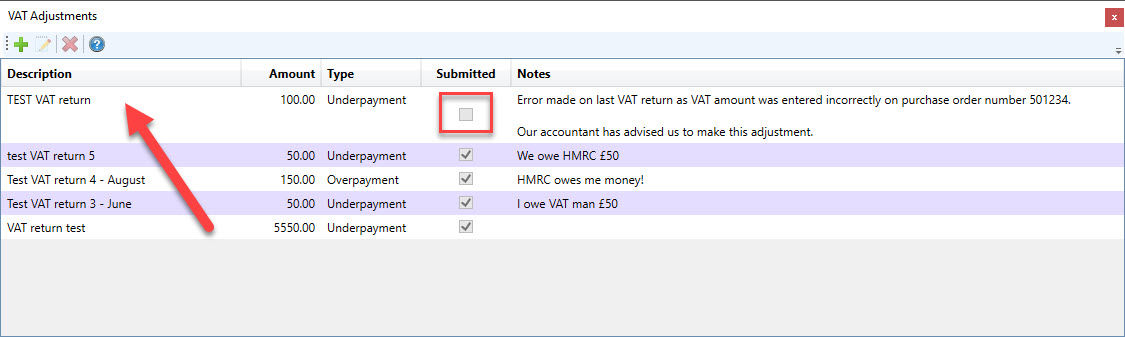

The VAT Adjustment is then saved in the main VAT Adjustments window.

As the VAT return it relates to, hasn't yet been submitted to HMRC, it will show as unticked in the Submitted box.

Here you can make Amendments to the VAT Adjustment or Delete it entirely.

To Amend an adjustment, click on the adjustment you wish to change (so it is highlighted in blue) and then click on the Edit button to make changes.

This will bring up the Edit VAT Adjustment window we've just seen above. Make any necessary amendments and click OK to save your changes.

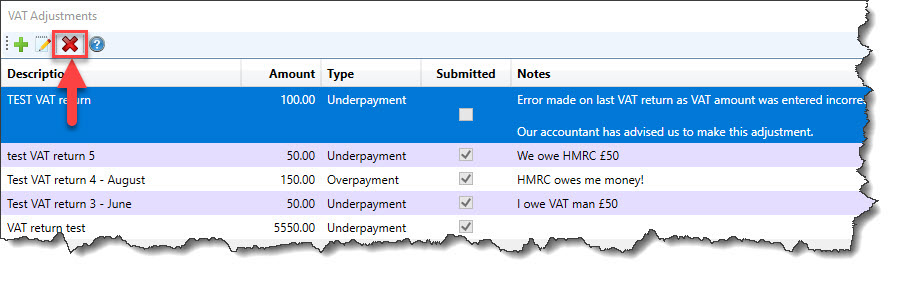

To Delete an adjustment, click on the adjustment you wish to change (so it is highlighted in blue) and then click on the Delete (Red Cross) button.

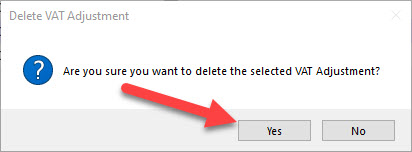

You will be asked to confirm that you want to delete the VAT adjustment:

Press Yes to Delete the VAT adjustment (or click No to cancel out the deletion and keep the adjustment).

NOTE: You will only be able to Edit or Delete VAT Adjustments that haven't yet been submitted to HMRC. If the VAT return that the adjustment relates to, has already been submitted, you won't be able to Edit or Delete the adjustment.

Also you will only be able to raise a New VAT Adjustment against a current VAT Return.

How a VAT Adjustment amends your VAT Return

Underpayment - ie you owe money to HMRC

When you generate the data for a VAT return which has an adjustment raised against it, the amount you owe HMRC or the amount you can reclaim from HMRC will be adjusted accordingly.

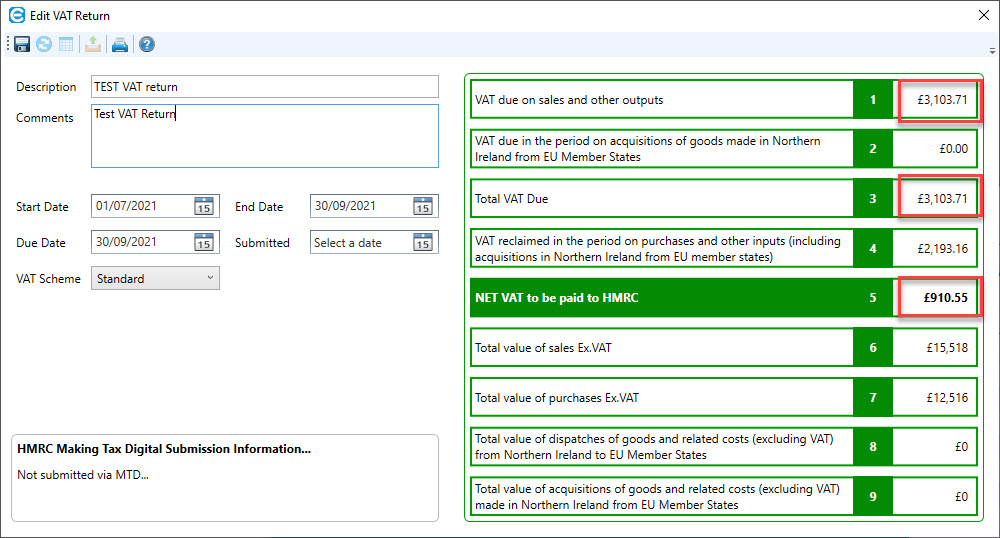

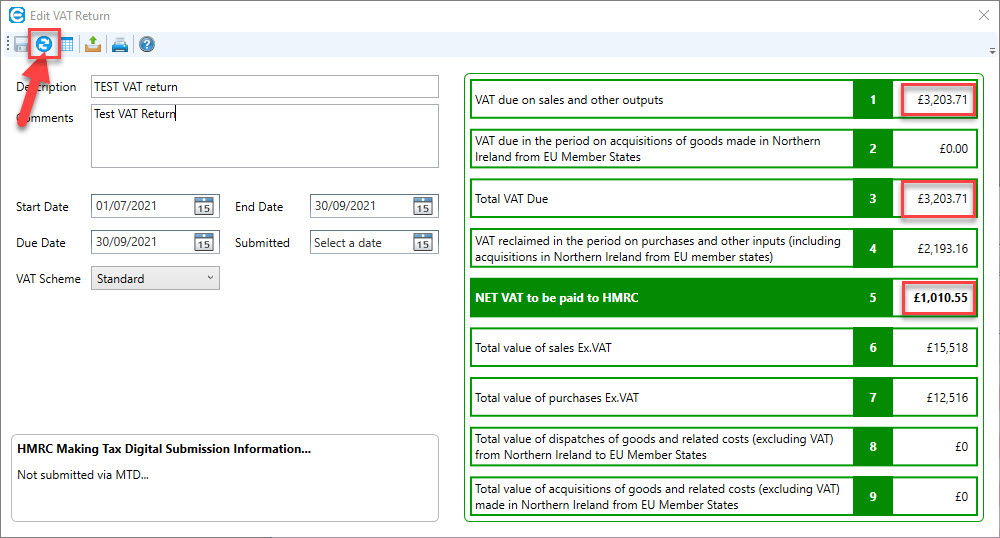

For example: This is a Test VAT return showing the amounts owed before we have recalculated to include the £100 VAT underpayment adjustment.

As you can see the NET VAT to be paid to HMRC is £910.55 (box 5) and the Sales VAT (box 1 and 3) is £3,103.71.

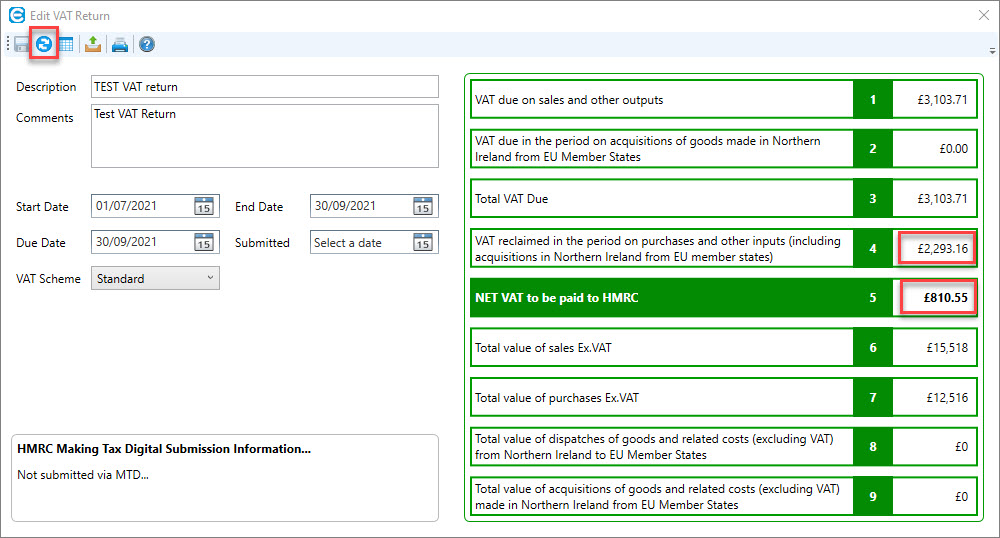

However when we recalculate / regenerate the VAT return to include the £100 VAT underpayment adjustment, the amount owed to HMRC increases by £100 to £1,010.55 and the Sales VAT increases by £100 to £3,203.71.

As this is an Underpayment VAT adjustment, the amount you owe to HMRC increases:

Overpayment - ie HMRC owes you money

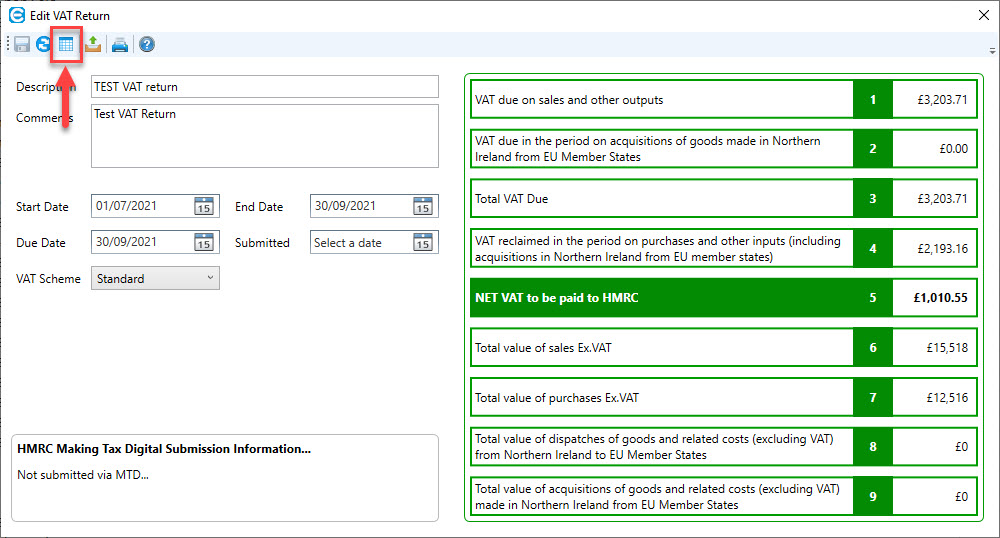

If the VAT adjustment is for a £100 overpayment, the VAT boxes will be adjustment in the same manner however the Purchases VAT (box 4) will increase by £100 and the NET VAT to be paid to HMRC will decrease by £100 (box 5).

As this is an Overpayment VAT adjustment, the amount you owe to HMRC decreases:

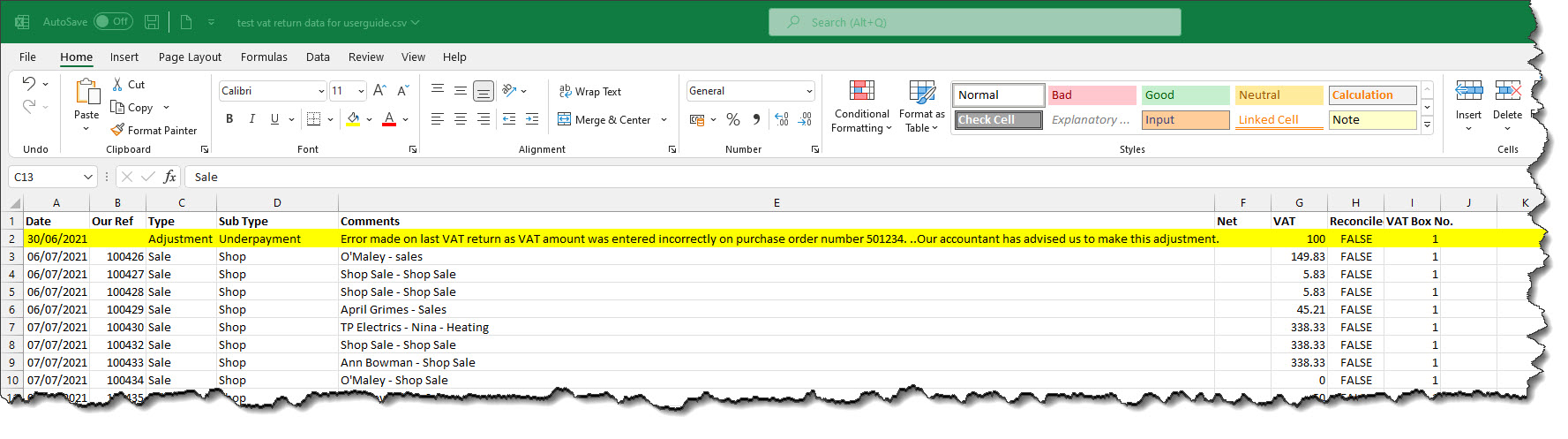

Before you submit a VAT return to HMRC, we always recommend exporting the data to a .csv file and checking it is correct.

To do this click on the Export VAT return data to .csv file button:

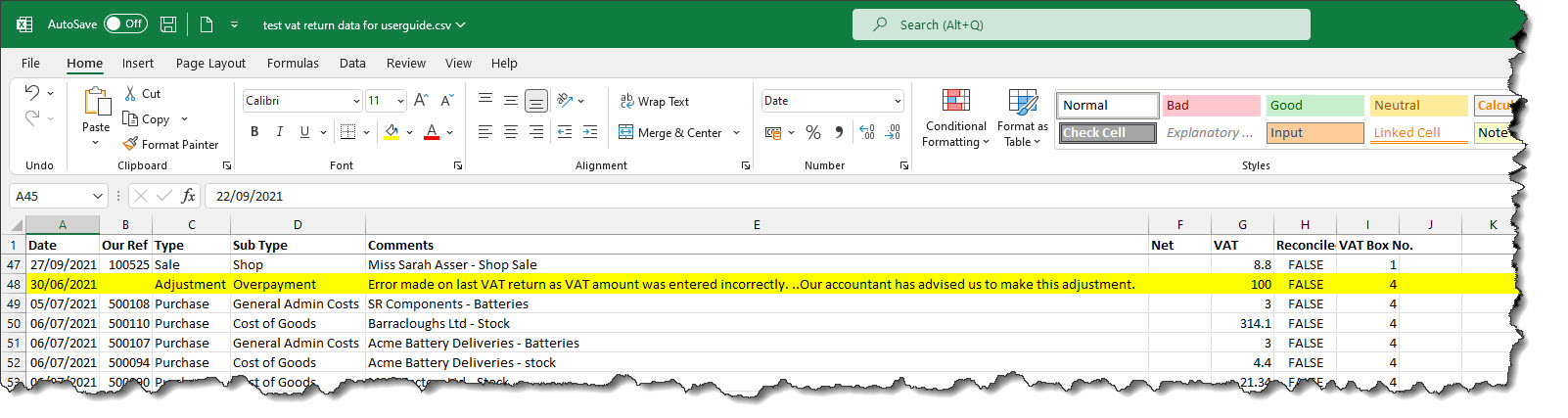

The.csv file (which can be opened in excel) will show the VAT adjustment

This the entry for the Underpayment VAT adjustment - as you can see Box 1 (Sales VAT) has been adjusted:

This the entry for the Overpayment VAT adjustment - as you can see Box 4 (Purchases VAT)has been adjusted:

Once you have submitted the VAT return that the VAT adjustment relates to, the VAT adjustment will show as Submitted and you won't be able to edit or delete it.

If you wish to see the details of a submitted VAT adjustment, you can either double click on it to open, or click on the VAT adjustment (so it is highlighted in blue) and then click on the Edit button to open the adjustment in a Read Only window.